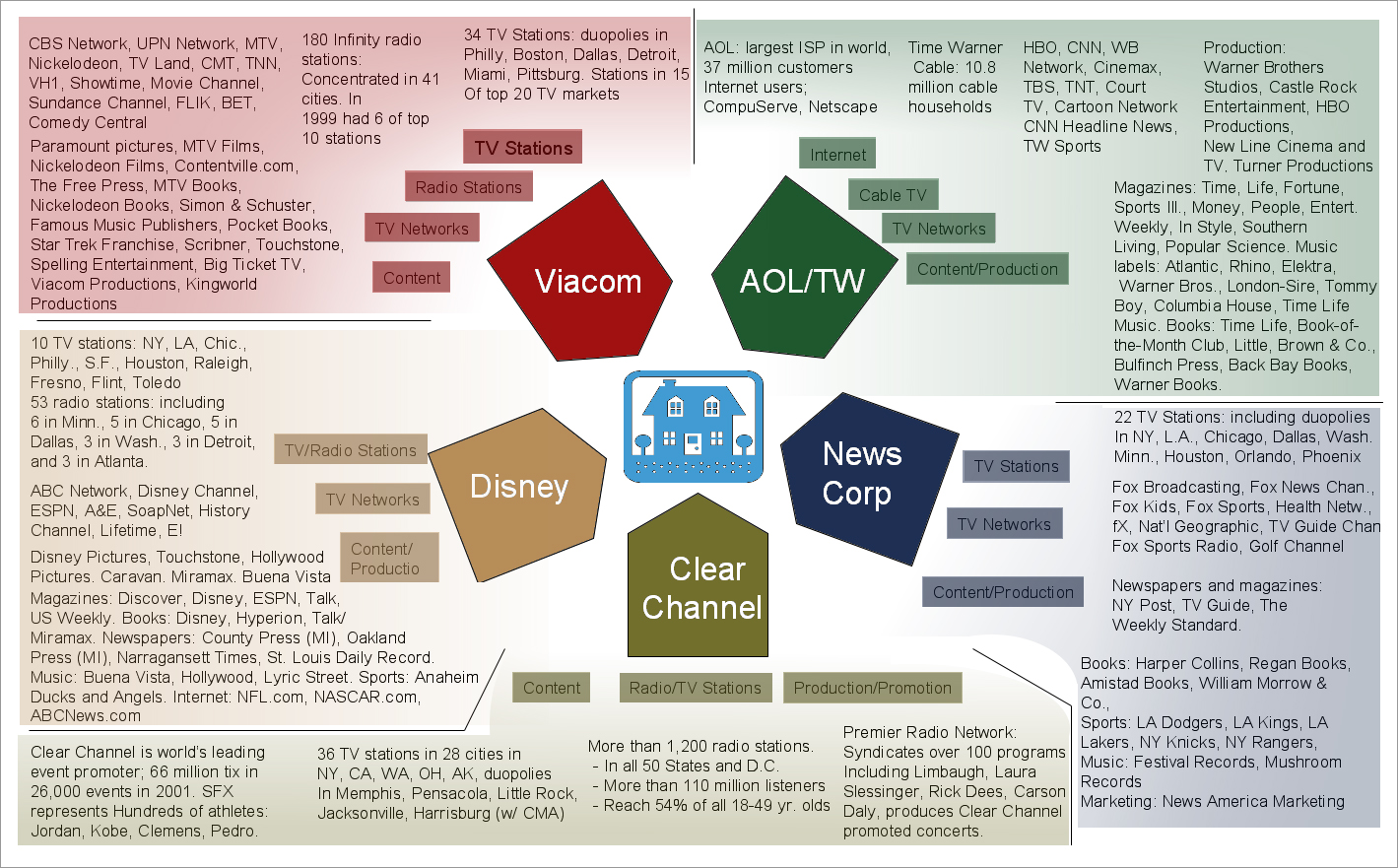

What we know (see image right, from Labor's Pains):

What we know (see image right, from Labor's Pains):

What we don't know:

From BradBlog:

The early Exit Poll results had reportedly predicted the race between Republican Gov. Scott Walker and Democratic Milwaukee Mayor Tom Barrett a virtual tie, leading media to plan for a long night tonight. A second round of Exit Polls results, however, were said to have given Walker a broader lead over Barrett. Even so, we were told, the race based on the Exit Poll data alone was still "too close to call." . . .(Links to more info in quoted portions are omitted but can be found at BradBlog.)

Of course, the raw, unadjusted Exit Polling data itself is no longer entrusted to us mere mortals. It can only be seen by members of the mainstream media, and we are simply left to trust them to report it all accurately to us or not. And when, after all, have we not been able to rely on the mainstream media to report everything accurately to us? But never mind the Exit Polls. We've got real polls, real votes, actual ballots now to tell us who won or lost. If only we'd bother to actually count them...

Instead, those ballots --- Wisconsin votes on mostly paper ballots --- are tabulated by computer optical-scan systems like the ones in Palm Beach County, FL which, in March of this year, had named several losing candidates to be the "winners". And like the ones in New York City which, in 2010, managed to toss out thousands of valid votes, including as many as 70% in one South Bronx precinct. And like the ones in Oakland County, Michigan where officials found the same machines failed to count the same ballots the same way twice in 2008. And like the ones in Leon County, FL which, in 2005, were hacked to entirely flip the results of a mock election.In Palm Beach County, FL the failure was discovered during a state mandated post-election spot-check of 2% of the paper ballots. In New York City, it took nearly two years before the failures were discovered after the New York Daily News was able to examine the paper ballots via a public records request. In Oakland County, MI, election officials were lucky enough to discover the failure during pre-election testing. And in Leon County, FL, the hacker --- a computer security expert --- revealed the op-scan system flaw he exploited to flip the results of the election in an Emmy-nominated HBO documentary.

And more of what we do know: Item 7 in my previous post here; see also here (and if you live in Wisconsin and don't know who Kathy Nickolaus is, see here); and see also the media-related labels below this post.

.jpg)

.jpg)

.jpg)

.jpg)