Who's saying it does? I've heard the claim attributed to Occupiers, but I personally haven't seen or heard any Occupiers make it.

In fact, I'd argue it's the 1% who've acted as if they believe the economy's a zero-sum game – and in so doing, have made it so.

Here are a couple of factors to think about (from my essay, Ten Things You Need to Know About the Infowar, which as far as I can tell no one has read, but they should, 'cuz as far as I can tell, it's still the case that hardly anyone else has put some of this stuff together):

8. Greater transparency maximizes efficiency and profits for a group as a whole, but individuals within the group profit most when they're not transparent while others in the group are.

There's a fascinating piece, "The Transparency Paradox," at colayer, regarding what I've called [Julian] Assange's theory of "the cost of tightened secrecy to organizational I.Q.," or as Volatility puts it more succinctly (more under Thing No. 9 below), his "secrecy tax." The author at colayer says studies show that, while greater transparency maximizes efficiency and profits for a group as a whole, individuals within the group profit most when they're not transparent while others in the group are.

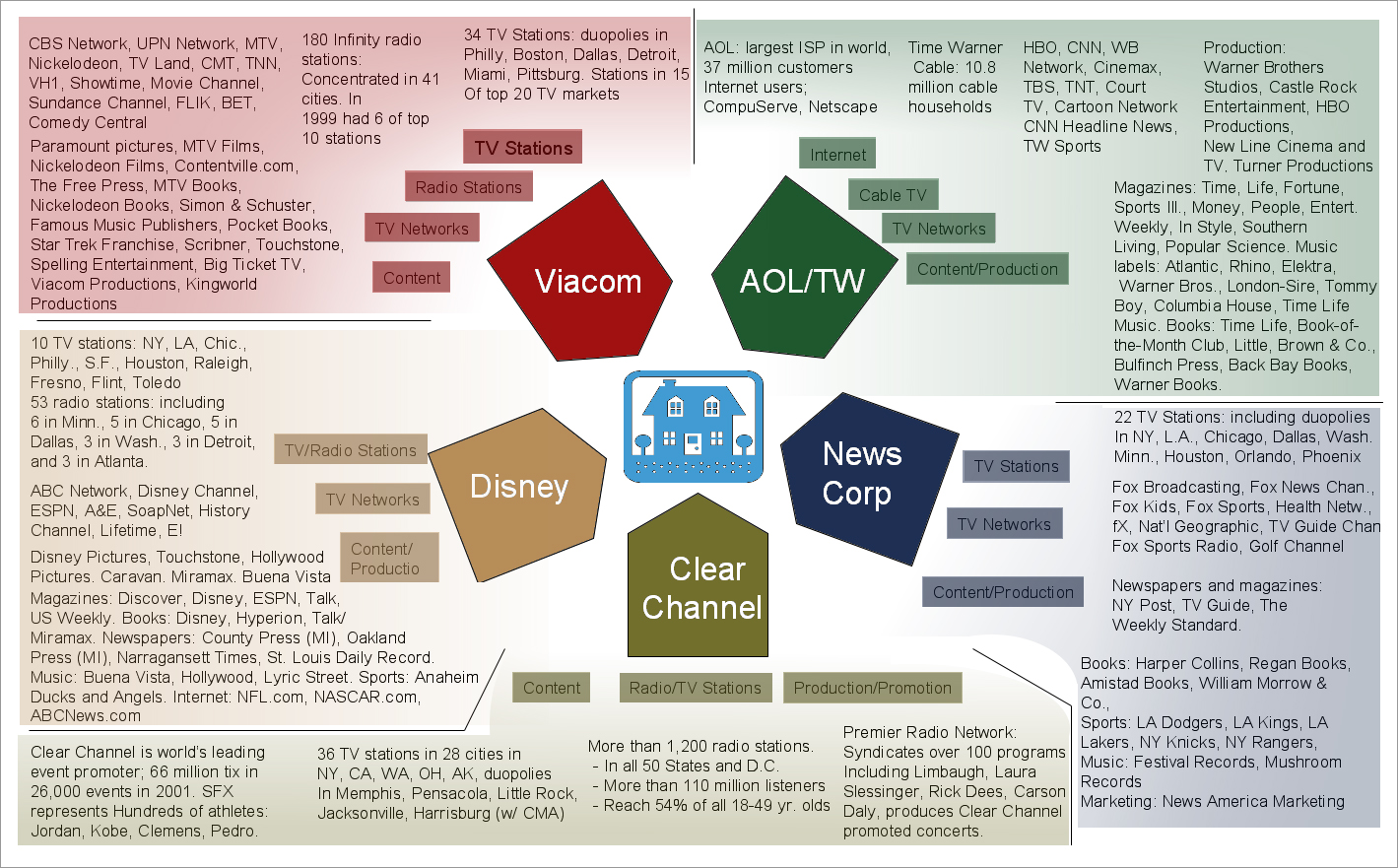

General transparency means that everyone has more useful info to work with, and can work together efficiently to solve problems and create wealth for all; the group benefits from the "wisdom of the crowd," as James Surowiecki would put it, or as Assange might say, the computational power of the system as a whole is maximized. (Image right from "The Transparency Paradox," at colayer.)

(Image right from "The Transparency Paradox," at colayer.)

And, colayer points out, the internet and other technologies now available have greatly reduced the cost of transparency.

But when you're negotiating, you have an advantage if you know what cards the other parties are holding but they're ignorant of yours.

I'd like again to emphasize again the importance of the dimension of time, which Assange has also written about, in his 2006 essay for counterpunch, "Of Potholes and Foresight." To put part of his point in other words, a stitch in time often saves nine, and transparency makes that kind of foresight possible, which otherwise tends to give way to political pressures to allocate resources in more near-sighted ways. Recall Wikileaks' logo (an hourglass). Or as someone else said, making a related but somewhat different point, " . . . Napoleon . . . said that it wasn't necessary to completely suppress the news; it was sufficient to delay the news until it no longer mattered." (attributed by PRWatch to Martin A. Lee & Norman Solomon, Unreliable Sources: A Guide to Detecting Bias in News Media (New York: Lyle Stuart, 1991), P. xvii; I hope the internet adopts Assange's "scientific journalism" and becomes better sourced, as well as more complete, soon).

* * * * *

9. So long as a system as a whole remains mostly transparent, it's a more-than-zero-sum game; but where transparency has sufficiently deteriorated, the competition among "players" devolves into a race to see who can loot the most the fastest, even if valuable resources (including personnel) are wasted in the process.

Re- the big, "systems" picture, there's a great article at Volatility on "racketeering":

According to Joseph Tainter’s theory of imperial collapse, as societies become more complex, they must expend an ever greater portion of the energy they have available simply on maintaining their complexity. Although social and technological advances may achieve profitable returns for awhile, once a certain level of complexity is reached, diminishing returns set in. Eventually, at the late imperial stage, the complexity of the power structure, the military infrastructure, the bureaucracies, all the rents involved in maintaining an ever more bloated parasite class, their luxuries, the police state required to extract these rents and keep the productive people down, and the growing losses due to the response of the oppressed producers, everything from poor quality work to strikes to emigration or secession to rebellion, reaches a point where the system can only cannibalize itself and eventually collapse.

Julian Assange’s theory of the secrecy tax he’s trying to impose through Wikileaks is one example of these diminishing returns on imperial complexity. All the indications are that Wikileaks has been successful in this.

* * * * *

This is a welter of parasites battening on the same host. They’re in a zero sum game, not only against the people, but among themselves. Each has an interest in just exploiting the host, not killing it. But together they are killing it and therefore themselves. It’s clear none is capable of organizing or regulating the others. The federal government isn’t capable of doing it. If one big bank tried to do it, it would be subverted by the others. Each racket, from highest to lowest, is going to maximize its bloodsucking until there’s no blood left.

I would argue that "complexity" is often associated with a lack of transparency. And I would argue that size matters greatly, since it's difficult for a large system to function without some kind of internal division of responsibilities, and that means complexity. One of the main respects in which both size and complexity matter has to do with the fact that they make it more difficult to keep track of what different individuals or agencies within the organization are doing and hold them accountable. In particular, those at the top of the hierarchy become less accountable to those along the bottom.

Again, theoretically, so long as the system as a whole remains mostly transparent, it's not a zero-sum game (or at least, its productivity growth would be subject only to such physical limits as peak oil or climate change), because problem-solving and general efficiency are maximized by pervasive info-sharing, plus everyone's equally incentivized. The system as a whole is greater than any one individual within it or even than the sum of its "parts."

(Still from Falls (2008).)

In contrast, where transparency has sufficiently deteriorated, workers become less productive, both because of reduced info-sharing and because they're disincentivized – i.e., those not sharing info are still incentivized to continue to exploit the others, but once those who are being exploited figure out what's going on, they're discouraged from sharing and working hard just to enrich the exploiters. At this point, the competition devolves from who can produce the most of the best, into who can loot the most the fastest. If anything, non-transparency should tend to result in something even worse than a zero-sum game, since not only are opportunities for growth wasted, but even resources already in existence may be at least partially wasted, since each actor is motivated to grab what it can even at the cost of spoiling portions of the remainder for possible use by others.

(As Julian Assange has observed, corrupt governments (and, I expect, other organizations) are inevitably secretive because their efforts to exploit people and interfere with their liberties tend to inspire resistance – see "State and Terrorist Conspiracies" and "Conspiracy as Governance" (2006) and Assange's post on his site, IQ.org, "

Per the Guardian,

Per the Guardian,

.jpg)

.jpg)

.jpg)

.jpg)